Introduction

Private money lenders have existed for centuries, but their popularity has significantly increased in the past decade. The growth of private money lending is due to several factors, including the tightening of traditional lending policies, changes in the lending market, and the high demand for lending services. The rise of private money lenders has created unique opportunities for investors, borrowers, and lenders.

How Does Private Money Lending Work?

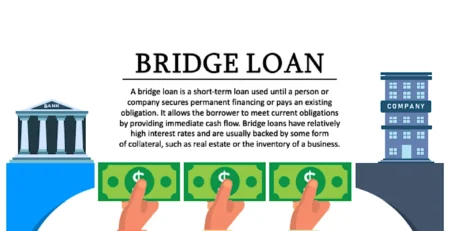

Private money lenders are individuals or companies that offer loans to borrowers. These loans are generally short-term, secured loans, with higher interest rates than traditional bank loans. The lending process typically completed in a shorter time frame than traditional loans, usually within a week.

Lenders require security for their loans, which is usually made up of property, such as a house, that is used as collateral. Lenders will only provide loans when the collateral has value that is greater than the loan amount. This ensures that they can recover their money if the borrower defaults on the loan.

Benefits of Private Money Lending

Private money lending has several advantages over traditional lending. These advantages include:

Flexibility: Private money lenders can offer flexible terms and conditions that align with the needs of borrowers. This flexibility is often lacking in traditional lending.

Speed: Private money lending is typically faster than traditional lending. The process can be completed within a week, whereas traditional lending can take weeks or even months.

Less stringent requirements: Lenders typically have less stringent requirements than traditional lenders. This makes it easier for borrowers who may not meet the strict criteria of traditional lenders to obtain financing.

Higher returns: Private money lenders receive higher returns than traditional lenders. This is because they charge higher interest rates, which compensates for the risk of lending to borrowers with a poor credit history.

The Rise of Private Money Lending

The rise of private money lenders can be attributed to several factors. These factors include:

Tightening of traditional lending policies: Traditional lenders, such as banks, have become more risk-averse in the wake of the global financial crisis. This has led to stricter lending policies that have made it more difficult for borrowers to obtain financing. Private money lenders have stepped in to fill the gap created by the tightening of traditional lending policies.

Changes in the lending market: Changes in the economy and lending market have created new opportunities for lenders. These changes include the growth of the sharing economy, the rise of peer-to-peer lending platforms, and the increased use of technology in lending.

High demand for lending services: The demand for lending services has increased in recent years due to a range of factors, including rising house prices, changing employment patterns, and the high cost of living. Private money lenders are meeting this demand by offering loans to borrowers who cannot obtain financing from traditional lenders.

Conclusion

The rise of private money lenders is changing the lending landscape, creating new opportunities for borrowers, investors, and lenders. The benefits of private money lending, including flexibility, speed, less stringent requirements, and higher returns, are driving the growth of this sector. As the lending market continues to evolve, private money lending is likely to become an increasingly important source of financing for borrowers.

Leave a Reply