Investing in real estate is not only a good way to diversify your portfolio, but it can also provide a steady source of passive income. Unfortunately, access to real estate funding can be a significant hurdle for many investors. Banks and traditional lenders, as opposed to private money lenders, often have stringent requirements, and the application process can be time-consuming and frustrating.

That is where private money lenders come in. Furthermore, private money lenders are individuals or companies who offer loans to real estate investors. Therefore, in this article, we will be analyzing the advantages and disadvantages of working with such money lenders.

Pros of working with private money lenders

1. Access to fast funding

Perhaps the most significant advantage of working with money lenders is quick access to funding. Traditional lenders take several weeks or months to process applications. This can be cumbersome for real estate investors, as they need funds to close deals quickly. These money lenders, on the other hand, can process and approve applications in a matter of days.

2. Flexible terms and conditions

Traditional lenders often have stringent requirements for borrowers, including high credit scores, a certain debt-to-income ratio, and a considerable down payment. Private money lenders, on the other hand, offer more flexible terms and conditions.

Private money lenders are generally more concerned with the value of the property than the borrower’s creditworthiness. As long as the property has the potential to generate a healthy return on investment, money lenders are more likely to provide funding.

3. Ability to finance unconventional projects

Traditional lenders often shy away from financing unconventional projects, such as fix-and-flip or construction projects. These projects carry with them a higher level of risk, and traditional lenders are often not comfortable with such ventures.

Private money lenders, on the other hand, are more willing to take risks on unconventional projects. They understand that unconventional projects have the potential to generate higher returns and are more willing to finance such ventures.

4. No requirement for a credit check

Unlike traditional lenders, private lenders do not require a credit check. This can be a significant advantage for real estate investors with poor credit scores. Private lenders are more concerned with the value of the property than the borrower’s creditworthiness.

Cons of working with private money lenders

1. Higher interest rates

One of the most significant disadvantages of working with private money lenders is higher interest rates. Private lenders offer funding to high-risk borrowers, and as such, they charge higher interest rates.

The interest rates charged by private lenders can be two or three times higher than those offered by traditional lenders. While the higher interest rates may be daunting, the ability to access funds quickly and easily may make up for it.

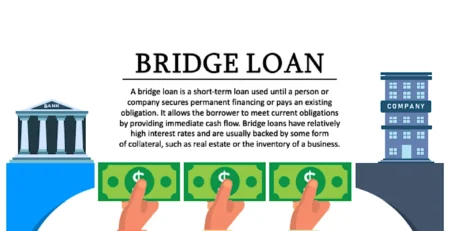

2. Shorter loan terms

Private money lenders offer shorter loan terms than traditional lenders. Traditional lenders offer loan terms of up to 30 years, while private lenders offer loan terms of up to five years.

The shorter loan terms can be a disadvantage for real estate investors, as they may need to refinance the loan after the term expires, which can be risky and expensive.

3. Limited legal protection

Unlike traditional lenders, private lenders are not subject to the same legal requirements and regulations. As such, they do not offer the same level of legal protection to borrowers.

Private money lenders often include clauses in the loan agreement that give them more rights and protection than the borrower. It is essential to read the loan agreement carefully before signing to avoid any surprises.

FAQs

1. What is a private money lender?

A private money lender is an individual or company that offers loans to real estate investors. Private money lenders are generally more concerned with the value of the property than the borrower’s creditworthiness.

2. How is borrowing from a private money lender different from borrowing from a traditional lender?

Borrowing from a private money lender is different from borrowing from a traditional lender in several ways. Private money lenders offer faster access to funding, more flexible terms, and conditions, and are more willing to finance unconventional projects. However, private money lenders charge higher interest rates and offer shorter loan terms than traditional lenders.

3. What are the benefits of working with a private money lender?

The benefits of working with a private money lender include fast access to funding, flexible terms and conditions, the ability to finance unconventional projects, and no requirement for a credit check.

4. What are the disadvantages of working with a private money lender?

The disadvantages of working with a private money lender include higher interest rates, shorter loan terms, and limited legal protection.

Conclusion

In conclusion, private money lenders can be a valuable resource for real estate investors. They offer faster access to funding, more flexible terms, and the ability to finance unconventional projects. However, borrowers should be aware of the higher interest rates, shorter loan terms, and limited legal protection that come with working with private lenders. It is essential to weigh the pros and cons carefully before deciding whether to work with a private money lender.

Leave a Reply