Introduction:

Real estate is one of the most lucrative investment opportunities in the world. However, not everyone has the financial resources to invest in real estate. That’s where real estate loans come in. With a real estate loan, you can borrow money to finance your real estate investment. Real estate loans come in different forms and have different terms. In this article, we will discuss how to maximize your investment potential with real estate loans.

Types of Real Estate Loans:

There are several types of real estate loans. Each type of loan has its own terms and conditions. Here are the most common types of real estate loans:

1. Traditional Mortgage: A traditional mortgage is a type of loan from a bank or a lending institution. This type of loan is used to finance the purchase of a property. The borrower has to repay the loan with interest over a period of time.

2. Commercial Mortgage: A commercial mortgage is a type of loan that is used to finance the purchase of commercial real estate. Commercial real estate includes properties such as office buildings, retail stores, and warehouses.

3. Home Equity Loan: A home equity loan is a type of loan that is given to homeowners who have equity in their homes. The borrower can borrow money against the equity in their home. Home equity loans are typically used to finance home improvements or other major expenses.

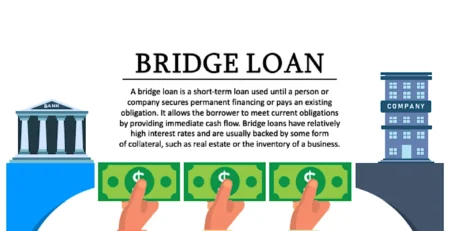

4. Bridge Loan: A bridge loan is a type of short-term loan that is used to finance the purchase of a property until a long-term financing option is available. Bridge loans are typically used by investors who want to purchase a property quickly.

Benefits of Real Estate Loans:

Real estate loans offer several benefits for investors. Here are some of the benefits of real estate loans:

1. Diversification: Real estate loans allow investors to diversify their portfolio. By investing in different types of real estate loans, investors can spread their risk across different investment options.

2. Leverage: Real estate loans allow investors to leverage their investments. By using a loan to finance their investment, investors can increase their purchasing power and maximize their investment potential.

3. Tax Benefits: Real estate loans offer several tax benefits. Investors can deduct the interest paid on their real estate loan from their taxes. Additionally, investors can depreciate the value of their property for tax purposes.

4. Cash Flow: Real estate loans can provide investors with a steady stream of income. By renting out their property, investors can generate a passive income stream that can help cover their mortgage payments.

Maximizing Your Investment Potential with Real Estate Loans:

Now that we have discussed the benefits of real estate loans, let’s discuss how to maximize your investment potential with real estate loans.

1. Choose the Right Type of Loan: The first step in maximizing your investment potential with real estate loans is to choose the right type of loan. Consider your investment goals, financial situation, and risk tolerance when choosing the type of loan.

2. Shop Around for the Best Deal: Once you have chosen the type of loan, it’s time to shop around for the best deal. Compare interest rates, fees, and terms from different lenders to find the best deal.

3. Invest in the Right Property: The success of your investment depends on the property you choose to invest in. Research the local real estate market and choose a property that will generate a steady income stream.

4. Manage Your Property: Once you have purchased your property, it’s important to manage it properly. Keep the property in good condition, find reliable tenants, and handle any issues that arise promptly.

FAQs:

Q: What is the minimum credit score required for a real estate loan?

A: The minimum credit score required for a real estate loan varies depending on the type of loan and the lender. Generally, a credit score of 620 or higher is required for a traditional mortgage.

Q: How much can I borrow for a real estate loan?=

A: The amount you can borrow for a real estate loan depends on several factors, including your credit score, income, and the value of the property. Generally, lenders will lend up to 80% of the property’s value.

Q: How long does it take to get approved for a real estate loan?

A: The approval process for a real estate loan varies depending on the type of loan and the lender. Generally, it can take several weeks to get approved for a traditional mortgage.

Q: Can I use a real estate loan to purchase a rental property?

A: Yes, real estate loans generlly used to purchase rental properties. In fact, rental properties are a popular investment option for real estate loans.

Q: What is the difference between a fixed-rate and an adjustable-rate mortgage?

A: A fixed-rate mortgage has a fixed interest rate for the duration of the loan. An adjustable-rate mortgage has an interest rate that can change over time.

Conclusion:

Real estate loans offer a great opportunity for investors to maximize their investment potential. By choosing the right type of loan, shopping around for the best deal, investing in the right property, and managing the property properly, investors can generate a steady income stream and build wealth over time.

Leave a Reply