Introduction:

In the realm of real estate, acquiring a new property often involves a complex process that can pose significant financial challenges, especially when selling an existing property falls out of sync with purchasing a new one. This is where a bridge loan mortgage comes into play. Designed to bridge the gap between the sale of one property and the purchase of another, bridge loans provide temporary financing solutions. In this comprehensive guide, we will explore the nuances of bridge loan mortgages and answer frequently asked questions to help you understand this essential tool in the real estate realm.

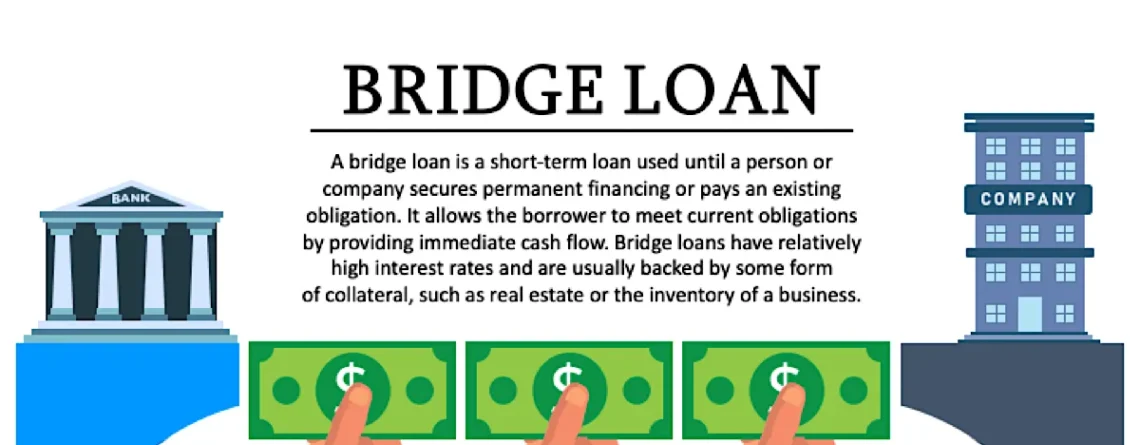

What is a Bridge Loan Mortgage?

A bridge loan mortgage is a short-term loan that bridges the gap between the purchase of a new property and the sale of an existing property. It serves as a temporary financing solution, enabling homeowners to secure funds for the down payment on a new property while waiting for the sale of their current one to close. The bridge loan mortgage allows borrowers to avoid a contingent offer and seize opportunities in the real estate market promptly.

How Does a Bridge Loan Mortgage Work?

Bridge loans are asset-based and rely on the existing property’s value, while the new property serves as collateral until the sale closes. The loan amount is determined by calculating the equity in the existing property after deducting the outstanding mortgage balance. Lenders often provide a portion of the estimated equity, typically up to 80%. Once the existing property is sold, the proceeds are used to repay the bridge loan mortgage along with any outstanding interest or fees.

Eligibility and Application Process:

To qualify for a bridge loan mortgage, borrowers usually need a strong credit score, substantial equity in their existing property, and a clearly defined selling timeline. The application process involves gathering the necessary documents, such as lender-required paperwork, proof of income, and property documentation. Additionally, lenders may conduct an appraisal and perform a background check to assess the property’s value.

Interest Rates and Terms:

Bridge loan mortgages generally carry higher interest rates compared to traditional mortgage loans due to their temporary nature and increased risk for lenders. These loans typically have shorter terms, ranging from a few weeks to a year, with the option for extension in some cases. It is important to understand the fees associated with bridge loans, including origination fees, interest rates, and potential early repayment penalties.

Pros and Cons of Bridge Loan Mortgages:

Bridge loan mortgages offer numerous advantages, such as speeding up the purchasing process, removing contingencies from offers, and allowing homeowners to secure new properties without waiting for their current one to sell. However, they also come with some drawbacks, including higher interest rates and the potential risk of being stuck with multiple properties if the existing property does not sell within the expected timeframe.

Alternatives to Bridge Loan Mortgages:

For those who may not qualify for or prefer not to obtain a bridge loan mortgage, several alternatives exist. These include home equity loans, home equity lines of credit (HELOCs), personal loans, and even cash-out refinancing. Each option has its own set of advantages and disadvantages, making it essential to evaluate individual circumstances before choosing the most suitable alternative.

Frequently Asked Questions (FAQs):

Q. What is the typical loan-to-value (LTV) ratio for a bridge loan mortgage?

The loan-to-value (LTV) ratio for bridge loan mortgages typically ranges from 60% to 80% of the property’s appraised value.

Q. How long do bridge loan mortgages generally last?

Bridge loan mortgages usually have terms between a few weeks and a year, with the average falling around six months.

Q. Can I obtain a bridge loan mortgage without having an existing property to sell?

While bridge loans primarily serve homeowners with existing properties, some lenders offer “bridge-to-construction” loans for those building a new property.

Q. Are bridge loan mortgages available for commercial properties too?

Yes, bridge loan mortgages are available for both residential and commercial properties.

Q. How do lenders evaluate the viability of bridge loan mortgage applicants?

Lenders assess various factors, including creditworthiness, property value, existing mortgage balance, planned sale timeline, and repayment ability.

Q. What happens if I am unable to sell my existing property within the bridge loan mortgage term?

In such cases, borrowers may need to extend the bridge loan, refinance it, or seek alternative financing options.

Q. Can bridge loan mortgages be used for renovations or home upgrades?

Yes, bridge loan mortgages can be used to finance renovations or home upgrades, enhancing a property’s value before selling it.

Conclusion:

Bridge loan mortgages are valuable financial tools that empower homeowners and property buyers to manage the daunting process of selling and purchasing a property concurrently. While they offer significant advantages, they also require careful consideration of risks, costs, and eligibility criteria. By understanding how bridge loan mortgages work, exploring alternatives, and addressing commonly asked questions, borrowers can make informed decisions to bridge the gap between one property and the next, ensuring a smooth transition in the real estate market.

Leave a Reply